(1) School of Information Systems

Queensland University of Technology

GPO Box 2434 Brisbane QLD 4001, Australia

{m.dumas, l.aldred, a.terhofstede, n.russell}@qut.edu.au

(2) ITEE

University of Queensland

Brisbane QLD 4072, Australia

guido@itee.uq.edu.au

(3) GBST Holdings Pty Ltd

5 Cribb St.

Milton QLD 4064, Australia

Copyright is held by the authors.

WWW2002, May 7-11, 2002, Honolulu, Hawaii, USA.

ACM 1-58113-449-5/02/0005.

The work reported in this paper addresses the issue of offer comparison in online auctions. The paper describes an approach to develop agents capable of participating in multiple potentially overlapping auctions, with the goal of winning exactly one of these auctions at the lowest possible price, given the following user parameters:

The approach also assumes that the bid histories of past auctions are available. Many Web-based auction houses provide such histories. For example, eBay provides bid histories for each auction up to 2 weeks after its completion, while Yahoo! does so for up to 3 months.

The approach is based on a prediction method and a planning algorithm. The prediction method exploits the history of past auctions in order to build probability functions capturing the belief that a bid of a given price may win a given auction. These probability functions are then used by the planning algorithm to compute the lowest price, such that by sequentially bidding in a subset of the relevant auctions, the agent can obtain the item at that price with a probability above the specified eagerness. In particular, the planning algorithm detects and resolves incompatibilities between auctions. Two auctions with equal or similar deadlines are considered to be incompatible, since it is impossible to bid in one auction, wait until the outcome of this bid is known (which could be at the end of that auction), and then bid in the other auction. Hence, given a set of mutually incompatible auctions, the planning algorithm must choose one of them to the exclusion of the others. This choice is done in a way to maximise the winning probability of the resulting plan.

The approach takes into account the case where the auctions are for substitutable items with different values (partial substitutes [2]). The user of a bidding agent can specify a different valuation for each of the relevant auctions, and the agent attempts to maximise the payoff according to these valuations. Alternatively, the user can identify a number of attributes for comparing the auctions, and specify his/her preferences through a multi-attribute utility function.

A series of experiments based on real datasets are reported, showing that the use of the proposed approach increases the individual payoff of the traders, as well as the collective welfare of the market.

The rest of the paper is structured as follows. Section 2 describes the technical details of the approach, including the prediction and planning methods. Section 3 describes a proof-of-concept implementation and summarises some experimental results. Finally, section 4 discusses related work, and section 5 draws some conclusions.

In the preparation phase, the agent assists the user in identifying a set of relevant auctions. Specifically, the user enters the parameters of the bidding agent (maximum price, deadline, eagerness) as well as a description of the desired item in the form of a list of keywords. Using this description, the agent queries the search engines of all the auction houses that it knows, and displays an integrated view of the results. By browsing through this integrated view, the user selects among all the retrieved auctions, those in which the agent will be authorised to bid. The selected auctions form what is subsequently called the set of relevant auctions. By extension, the auction houses hosting the auctions in this set form the set of relevant auction houses.

For each relevant auction house, the agent gathers the bidding histories of every the past auction whose item description matches the list of keywords provided by the user. These bidding histories are used by the prediction method in order to build a function that given a bidding price, returns the probability of winning an auction by bidding (up to) that price. Note that the histories extracted from an auction house are only used to compute probability functions for the auctions taking place in that auction house. Thus, auctions running in different auction houses may have completely different probability functions.

During the preparation phase, the agent also conducts a series of tests

to estimate the average time that it takes to execute a transaction (e.g.,

to place a bid or to get a quote) in each of the auction houses in which

it is likely to bid. The time that it takes to execute a transaction in

an auction house is stored in a variable ![]() . The value of this variable is updated whenever the agent interacts with

the corresponding auction house.

. The value of this variable is updated whenever the agent interacts with

the corresponding auction house.

In the planning phase, the bidding agent selects a set of auctions and

a bidding price r (below the user's maximum), such that the probability

of getting the desired item by consistently bidding r in each of

the selected auctions is above the eagerness factor. The resulting

bidding

plan, is such that any two selected auctions a1 and a2 have end times

separated by at least ![]() .

In this way, it is always possible to bid in an auction, wait until the

end of that auction to know the outcome of the bid (by asking for a quote),

and then place a bid in the next auction.

.

In this way, it is always possible to bid in an auction, wait until the

end of that auction to know the outcome of the bid (by asking for a quote),

and then place a bid in the next auction.

The problem of constructing a bidding plan can be formally stated as

follows. Given the set of relevant auctions ![]() ,

find:

,

find:

where ![]() is the probability that a bid of

is the probability that a bid of ![]() will succeed in auction a.

will succeed in auction a.

In the execution phase, the bidding agent executes the bidding plan by successively placing bids in each of the selected auctions, until one of them is successful. In the case of sealed-bid auctions (whether first-price or second-price) the bidding agent simply places a bid of amount r. The same principle applies in the case of an English auction with proxy bids: the agent directly places a proxy bid of amount r. Finally, in the case of an English auction without proxy bids, the agent will place a bid of amount r just before the auction closes, since last-minute bidding is an optimal strategy in this context [10].

During the execution phase, the agent periodically searches for new auctions matching the user's item description, as well as for up-to-date quotes from the auctions in the bidding plan. Based on this information, the agent performs a plan revision under either of the following circumstances:

Formally, we define the histogram of final prices of an auction type,

to be the function that maps a real number x, to the number of past

auctions of that type (same item, same auction house) whose final price

was exactly x. The final price of an auction a with no bids

and zero reservation price, is then modelled as a random variable![]() whose probability distribution, written

whose probability distribution, written ![]() ,

is equal to the histogram of final prices of the relevant auction type,

scaled down so that its total mass is 1. The probability of winning an

auction with a bid of x assuming a null reservation price, is given

by the cumulative version of this distribution, that is:

,

is equal to the histogram of final prices of the relevant auction type,

scaled down so that its total mass is 1. The probability of winning an

auction with a bid of x assuming a null reservation price, is given

by the cumulative version of this distribution, that is:

![]()

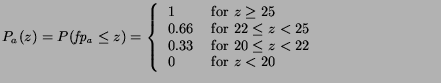

for an appropriate discretisation of the interval [0,z]. For example, if the sequence of observed final prices is [22, 20, 25], the cumulative distribution at the beginning of an auction is:

In the case of an auction with quote (which is determined by the reservation price and the public bids), the probability of winning with a bid of z is:

The histogram method has two drawbacks. First, the computation of the value of the cumulative distribution at a given point, depends on the size of the set of past auctions. Given that the bidding agent heavily uses this function, this can create an overhead for large sets of past auctions. Second, the histogram method is inapplicable if the current quote of an auction is greater than the final price of all the past auctions, since the denominator of the above formula is then equal to zero. Intuitively, the histogram method is unable to extrapolate the probability of winning in an auction if the current quote has never been observed in the past.

The normal method addresses these two drawbacks, although it

is not applicable in all cases. Assuming that the number of past auctions

is large enough (more than 50), if the final prices of these auctions follow

a normal distribution with mean ![]() and standard deviation

and standard deviation ![]() ,

then the random variable

,

then the random variable ![]() can be given the normal distribution

can be given the normal distribution ![]() .

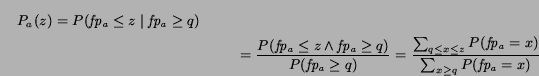

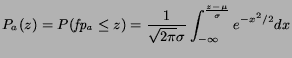

The probability of winning with a bid z in an auction with no bids

and zero reservation price, is then given by the value at z of the

corresponding cumulative normal distribution:

.

The probability of winning with a bid z in an auction with no bids

and zero reservation price, is then given by the value at z of the

corresponding cumulative normal distribution:

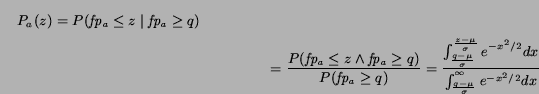

Meanwhile, if the current quote q of an auction is greater than zero, the probability of winning this auction with a bid of z is:

Many fast algorithms for approximating the integrals appearing in these

formulae as well as their inverses are described in [13].

The complexity of these algorithms is only dependent on the required precision,

not on the size of the dataset from which ![]() and

and ![]() are derived. Hence, the normal method can scale up to large sets of past

auctions.

are derived. Hence, the normal method can scale up to large sets of past

auctions.

The normal method is able to compute a probability of winning an auction with a given bid, even if the value of the current quote in that auction is greater than all the final prices observed in the past. This is because the domain of the normal distribution is the whole set of real numbers, unlike discrete distributions such as those derived from histograms.

Yet another advantage of the normal method, is that it can be adapted to take into account data aging. If the history of past auctions covers a large period of time, one can consider using time-weighted averages and standard deviations instead of plain ones. In this way, recent observations are given more importance than older ones.

In support of the applicability of the normal method, it can be argued that the final prices of a set of auctions for a given item are likely to follow a normal distribution, since the item has a more or less well-known value, around which most of the auctions should finish. An analysis conducted over datasets extracted from eBay and Yahoo! (two of these datasets are described in section 3) was performed to validate this claim. The final prices of 4 histories of auctions were tested for normality. The results were consistently positive for all prefixes of more than 50 elements of these histories. The D'Agostino-Pearson normality test [5] was used in this analysis.

In a Vickrey or in an English auction, the final price of an auction does not reflect the limit price (or valuation) that the highest bidder was willing to pay, but rather the limit price of the second highest bidder. If the prediction methods described above were applied directly to a history of final prices of Vickrey and/or English auctions, the result would be that the bidding agent would be competing against the second highest bidders, rather than against the highest ones. In order to make the prediction methods previously described applicable to Vickrey and English auctions, we need to map a set of bidding histories of Vickrey or English auctions, into an equivalent set of bidding histories of FPSB auctions. This means extrapolating how much the highest bidder was willing to pay in an auction, knowing how much the second highest bidder (and perhaps also other lower bidders) was/were willing to pay.

We propose the following extrapolation technique. First, the bidding histories of all the past auctions are considered in turn, and for each of them, a set of known valuations is extracted. The highest bid in a Vickrey auction or in an English-Proxy auction is taken as the known valuation of the second highest bidder of that auction. The same holds in an English auction without proxy bids, provided that there were no last minute bids. Indeed, in the absence of last minute bids, one can assume that the second highest bidder had the time to outbid the highest bidder, but did not do so because (s)he had reached his valuation. Similarly, it is possible under some conditions to deduce the valuation of the third highest bidder, and so for the lower bidders.

Next, the set of known valuations of all the past auctions are merged

together to yield a single set of numbers, from which a probability distribution

is built using either a histogram method, a normal method, or any other

appropriate statistical technique. In any case, the resulting distribution,

subsequently written ![]() ,

takes as input a price, and returns the probability that there is at least

one bidder willing to bid that price for the desired item.

,

takes as input a price, and returns the probability that there is at least

one bidder willing to bid that price for the desired item.

Finally, for each auction a in the set of past auctions, a series

of random numbers are drawn according to distribution ![]() ,

until one of these numbers is greater than the observed final price of

auction a. This number is then taken to be the valuation of the

highest bidder, which would have been the final price had the auction been

FPSB. By applying this procedure to each past auction in turn, a history

of ``extrapolated'' final prices is built. This extrapolated history is

used to build a new probability distribution using the methods previously

described in the setting of FPSB auctions. In other words, an extrapolated

history built from a set of Vickrey or English auctions, is taken to be

equivalent to a history of final prices of FPSB auctions.

,

until one of these numbers is greater than the observed final price of

auction a. This number is then taken to be the valuation of the

highest bidder, which would have been the final price had the auction been

FPSB. By applying this procedure to each past auction in turn, a history

of ``extrapolated'' final prices is built. This extrapolated history is

used to build a new probability distribution using the methods previously

described in the setting of FPSB auctions. In other words, an extrapolated

history built from a set of Vickrey or English auctions, is taken to be

equivalent to a history of final prices of FPSB auctions.

Given a bidding price r, the problem of retrieving the subset ![]() with maximal

with maximal ![]() ,

can be mapped into a graph optimisation problem. Each auction is mapped

into a node of a graph. The node representing auction a is labeled

with the probability of losing auction a by bidding r, that

is:

,

can be mapped into a graph optimisation problem. Each auction is mapped

into a node of a graph. The node representing auction a is labeled

with the probability of losing auction a by bidding r, that

is: ![]() .

An edge is drawn between two nodes representing auctions a1

and a2 iff a1 and a2 are compatible, that is:

.

An edge is drawn between two nodes representing auctions a1

and a2 iff a1 and a2 are compatible, that is: ![]() .

The edge goes from the auction with the earliest end time to that with

the latest end time. Given this graph, the problem of retrieving a set

of mutually compatible auctions such that the probability of losing all

of them (with a bid of r) is minimal, is equivalent to the critical

path problem [4]. Specifically, the problem

is that of finding the path in the graph which minimises the product of

the labels of the nodes. The classical critical path algorithm has a complexity

linear on the number of nodes plus the number of edges. In the problem

at hand, the number of nodes is equal to the number of auctions, while

the number of edges is (in the worst case) quadratic on the number of auctions.

Hence, the complexity of the resulting

BestPlan algorithm is

.

The edge goes from the auction with the earliest end time to that with

the latest end time. Given this graph, the problem of retrieving a set

of mutually compatible auctions such that the probability of losing all

of them (with a bid of r) is minimal, is equivalent to the critical

path problem [4]. Specifically, the problem

is that of finding the path in the graph which minimises the product of

the labels of the nodes. The classical critical path algorithm has a complexity

linear on the number of nodes plus the number of edges. In the problem

at hand, the number of nodes is equal to the number of auctions, while

the number of edges is (in the worst case) quadratic on the number of auctions.

Hence, the complexity of the resulting

BestPlan algorithm is ![]() .

.

An alternative algorithm with linear complexity can be devised in the

case where all the auctions are equally reachable (i.e., they all have

the same ![]() ).

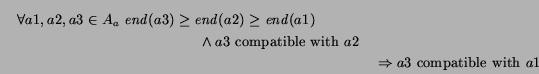

In this situation, the following property holds:

).

In this situation, the following property holds:

Given this property, it is possible to find the best plan as follows.

The set ![]() ,

sorted by end times, is scanned once. At each step, the best predecessor

of the currently considered auction is incrementally computed. Specifically,

the best predecessor of the current auction is either the best predecessor

of the previous auction, or one of the auctions which are compatible with

the current auction and not compatible with the previous auction. This

incremental computation takes constant time when amortised over the whole

set of iterations. For example, consider Table 1.

Assuming that

,

sorted by end times, is scanned once. At each step, the best predecessor

of the currently considered auction is incrementally computed. Specifically,

the best predecessor of the current auction is either the best predecessor

of the previous auction, or one of the auctions which are compatible with

the current auction and not compatible with the previous auction. This

incremental computation takes constant time when amortised over the whole

set of iterations. For example, consider Table 1.

Assuming that ![]() is constant for all auctions, the best path for this set of auctions is

the sequence [1,2,5,6] and the associated probability of winning is

is constant for all auctions, the best path for this set of auctions is

the sequence [1,2,5,6] and the associated probability of winning is ![]() .

This path can be found by sequentially scanning the sequence of auctions

sorted by end times. When auction 4 is reached, the choice between bidding

in auctions 2 and 3 (which are incompatible) is done. Similarly, when auction

6 is reached, the choice between auctions 4 and 5 is done. Over the whole

set of iterations, the average time that it takes to compute the best predecessor

of an auction is equal to one operation. The resulting linear-complexity

algorithm

BestPlan' is given in appendix A.

.

This path can be found by sequentially scanning the sequence of auctions

sorted by end times. When auction 4 is reached, the choice between bidding

in auctions 2 and 3 (which are incompatible) is done. Similarly, when auction

6 is reached, the choice between auctions 4 and 5 is done. Over the whole

set of iterations, the average time that it takes to compute the best predecessor

of an auction is equal to one operation. The resulting linear-complexity

algorithm

BestPlan' is given in appendix A.

| Auction # | 1 | 2 | 3 | 4 | 5 | 6 |

| End Time | 4 | 7 | 8 | 11 | 12 | 14 |

| Win Probability | .8 | .8 | .7 | .8 | .9 | .9 |

In the price differentiation approach, the user specifies a limit price

for each relevant auction. The agent uses these limit prices to compute

relative valuations between the auctions. For example, if the user specifies

a limit price of 100 in auction A1, and 80 in auction A2, A2 is said to

have a relative valuation of 80% with respect to A1. Consequently, the

agent will prefer bidding $70 in A1 rather than bidding $60 in A2 (since ![]() ),

but it will prefer bidding $60 in A2, rather than $80 in A1 (since

),

but it will prefer bidding $60 in A2, rather than $80 in A1 (since ![]() ).

More generally, given a set of relevant auctions

).

More generally, given a set of relevant auctions ![]() with limit prices

with limit prices ![]() ,

the agent computes a set of

proportionality factors

,

the agent computes a set of

proportionality factors ![]() ,

such that

,

such that ![]() .

The proportionality factor

.

The proportionality factor ![]() of auction Ai is the relative importance of Ai with

respect to the auction(s) with the highest limit price. During the planning

phase, whenever the algorithm BestPlan (or

BestPlan') would

consider the possibility of placing a bid of x in an auction Ai,

the algorithm considers instead the possibility of placing a bid of

of auction Ai is the relative importance of Ai with

respect to the auction(s) with the highest limit price. During the planning

phase, whenever the algorithm BestPlan (or

BestPlan') would

consider the possibility of placing a bid of x in an auction Ai,

the algorithm considers instead the possibility of placing a bid of ![]() (line 6 of algorithm

BestPlan', appendix A).

As a result, higher bidding prices are considered for auctions with higher

limit prices. Accordingly, during the execution phase, if the bidding price

computed during the planning phase is r, the agent places a bid

of

(line 6 of algorithm

BestPlan', appendix A).

As a result, higher bidding prices are considered for auctions with higher

limit prices. Accordingly, during the execution phase, if the bidding price

computed during the planning phase is r, the agent places a bid

of ![]() in auction Ai.

in auction Ai.

The utility differentiation approach is based on Multi-Attribute Utility Theory (MAUT). Concretely, the user identifies a set of criteria for comparing auctions (e.g., price, quality, seller's reputation, and warranty), and specifies a weight for each criterion (e.g., 50% for the price, 20% for the quality, 20% for the seller's reputation, 10% for the warranty). Next, for each relevant auction and for each criterion (except the price), the user manually or through some automated method provides a score: a rating of the auctioned item with respect to the considered criterion. Finally, the user specifies the limit price that (s)he is willing to bid in any auction (called M).

Given all the scores and weights, the agent computes for each auction

Ai,

a utility ex price ![]() ,

where

,

where ![]() denotes the weight of criterion

denotes the weight of criterion ![]() ,

and

,

and ![]() denotes the score given to criterion

denotes the score given to criterion ![]() in auction Ai (the sum is done over all the criteria except the

price). The limit price Mi to pay in auction Ai is

defined as:

in auction Ai (the sum is done over all the criteria except the

price). The limit price Mi to pay in auction Ai is

defined as: ![]() ,

where

,

where ![]() is the weight given by the user to the price (thus

is the weight given by the user to the price (thus ![]() is the weight given to all the other criteria), and

is the weight given to all the other criteria), and ![]() is the maximum element in the set

is the maximum element in the set ![]() .

In particular, for an auction with maximal utility ex price, the limit

price is M, For an auction with non-maximal utility ex price, the

limit price is lower than M by an amount proportional to the difference

between the highest valuation ex price, and the valuation ex price of that

auction. The weight given by the user to the price (i.e.,

.

In particular, for an auction with maximal utility ex price, the limit

price is M, For an auction with non-maximal utility ex price, the

limit price is lower than M by an amount proportional to the difference

between the highest valuation ex price, and the valuation ex price of that

auction. The weight given by the user to the price (i.e., ![]() )

acts as a gearing factor in this proportionality: the lowest is

)

acts as a gearing factor in this proportionality: the lowest is ![]() ,

the highest is the amount that will be taken off from M to determine

the limit price of an auction with non-maximal utility.

,

the highest is the amount that will be taken off from M to determine

the limit price of an auction with non-maximal utility.

Once the set of limit prices ![]() of each auction has been computed, the bidding agent applies the price

differentiation approach (see above).

of each auction has been computed, the bidding agent applies the price

differentiation approach (see above).

Seed data Datasets obtained from eBay were used as a ``seed''

to create virtual auctions. Specifically, two sets of bidding histories

were collected. The first dataset contained 300 auctions for new PalmVx

PDAs over the period 17 June - 15 July 2001. The second dataset contained

100 auctions for new Nokia 8260 cellular phones over the period 13 June

2001 - 31 July 2001. The choice of the datasets was motivated by the high

number of overlapping auctions that they contained.

Local Bidder A local bidder is a simple agent that simulates

the presence of an ordinary bidder within an auction. The bidding agent

is assigned a limit price. The agent places a (proxy) bid at this price

at some point during its lifecycle. The limit price of a local bidder is

generated randomly based on the seed data. Specifically, the average and

standard deviation of the final prices of the auctions in the seed data

are used to build a random number generator with a normal distribution,

and this generator is used to assign limit prices to the local bidders.

Probabilistic Bidder An agent implementing the approach proposed

in this paper. A probabilistic bidder has a limit price, an eagerness,

and a deadline. The normal prediction method and the optimised planning

algorithm were used. All items were considered to be identical (no partial

substitutes). We estimate that simulating a marketplace with partial substitutes

is a subject for a separate work.

Virtual Auction House A software providing the functionality

of an online auction house such as creating an auction, placing a bid,

obtaining a quote, or obtaining the history of past auctions. All these

functionalities were encapsulated in a Java package designed to work as

an RMI server.

Virtual Auctions A virtual auction runs within an auction house.

In the experiments, there was a one-to-one correspondence between a ``real''

auction recorded in the seed data, and a virtual auction. The period of

time during which a virtual auction ran was obtained by scaling down and

offsetting the period of time during which the corresponding ``real'' auction

occurred. All virtual auctions were English with proxy bidding.

Simulation A simulation is set of virtual auctions in which local bidders and probabilistic bidders compete to obtain a given type of item. A simulation involves the following steps:

Simulation Bundle a group of simulations with identical parameters. The number of simulations composing a bundle is given by the parameters numSims. In addition to this parameter, a simulation bundle has exactly the same parameters as a single simulation.

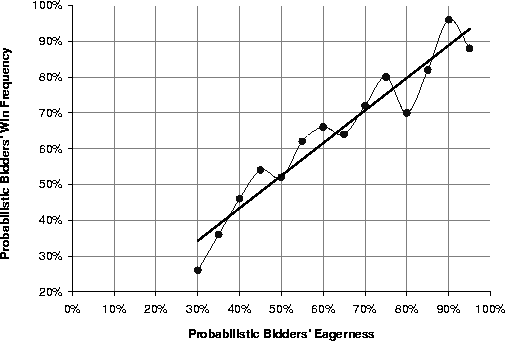

Claim 1 The percentage of times that a probabilistic bidder

succeeds to obtain an item is equal to its eagerness.

To validate this claim, we conducted an experiment consisting of 14 simulation bundles: each one designed to measure the percentage of wins of one probabilistic bidder with a given eagerness. The eagerness was varied between 30% and 95% at steps of 5%. The other parameters of the simulation bundles were: -numSims 50 -dataset PalmVx -numLocals 3 -limitPrice 300 -creationTime 0.5. The limit price of the probabilistic bidders was 10 standard deviations above the average winning price, so that there was little risk that the agent failed due to an insufficient limit price.

|

The expected result was that the percentage of wins is equal to the eagerness. The linear regression of the experimental results supports the claim (Figure 1): it shows an almost perfect correlation between an increase in eagerness and an increase in the percentage of wins.

Interestingly, the fact that the bidding histories of English auctions are adjusted before being used to compute a probability function (see section 2.2.2), plays a crucial role in ensuring that the percentage of wins is equal to the eagerness. We conducted the same experiment as above without adjusting the bidding histories. The result was that the percentage of wins was consistently lower than the eagerness, meaning that the expectations of the user were not fulfilled.

We also conducted experiments to observe the correlation between the

average winning price of the probabilistic bidder and its eagerness. The

results of these experiments are shown in the following table. These results

show a linear increase of the price paid by the probabilistic bidder as

the eagerness is increased.

| Eagerness | Winning price | Eagerness | Winning price |

| 30% | $211.22 | 65% | $212.42 |

| 35% | $211.46 | 70% | $213.17 |

| 40% | $211.15 | 75% | $213.53 |

| 45% | $211.50 | 80% | $213.38 |

| 50% | $212.31 | 85% | $213.84 |

| 55% | $212.86 | 90% | $214.39 |

| 60% | $212.65 | 95% | $215.48 |

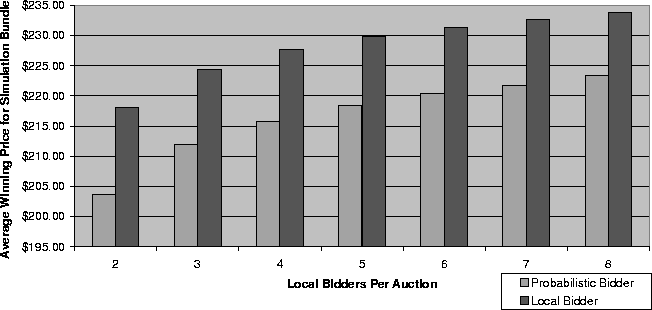

Claim 2 Probabilistic bidders pay less than local bidders, especially in competitive environments. In other words, probabilistic bidders increase the payoff of their users.

To validate this claim, we conducted an experiment consisting of 7 simulation bundles: each testing the performance of one probabilistic bidder competing against local bidders in an increasingly competitive market. The number of local bidders per auction was varied from 2 to 8. The parameters passed to the simulations included: -dataset PalmVx -numSims 50 -eagerness 0.9 -creationTime 0.5.

The expected results were (i) that the increasing competition raises the average final price of the auctions, and (ii) that despite the increased competition the probabilistic bidder tends to keep its bidding price as low as possible. The actual experimental results (Figure 2) clearly match these expectations. Other experiments with different eagerness yielded similar results.

|

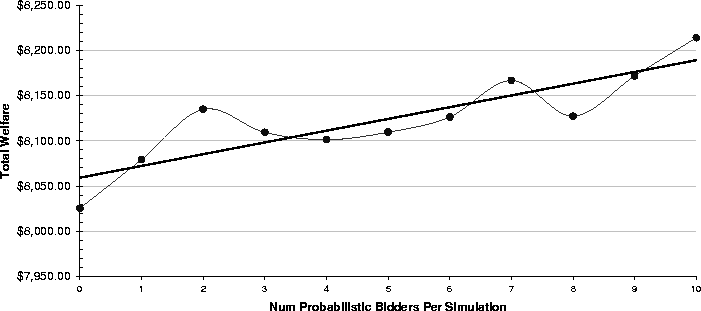

Claim 3 The welfare of the market increases with the number of probabilistic bidders.

The market welfare is defined as the welfare of the bidders plus the welfare of the sellers. The welfare of a seller is the difference between the price at which (s)he sells an item, and his/her reservation price. The welfare of a bidder (whether probabilistic or local) is the difference between his/her limit price, and the price actually paid. If a bidder does not win any auction, it does not contribute to the market welfare. A similar remark applied for sellers.

This claim was validated through an experiment consisting of 11 simulation bundles with increasing numbers of probabilistic bidders. Each time that a probabilistic bidder was added, one local bidder was removed. The parameters passed to this set of simulations included: -dataset PalmVx -numSims 30 -numLocals 3 -eagerness 0.9 -creationTime 0.5. The limit prices of the probabilistic bidders were set in the same way as those of the winning local bidders (see section 3.1). The market welfare was measured at the end of each bundle.

|

The expected result was that the market welfare will increase as more probabilistic bidders are introduced. The results of the experiment (Figure 3) validate the claim by showing an increase of the market welfare as new probabilistic bidders are introduced. When adding 10 probabilistic bidders into a market containing 900 local bidders, the welfare increased by 2.35%. Other experiments with different eagerness yielded similar results.

The increase of the market welfare can be explained by observing that when a local bidder with a low valuation wins an auction as an effect of chance, it contributes less to the overall welfare than a probabilistic bidder with a higher valuation would do if it won the same auction. In other words, the fact that the probabilistic bidder bids in many auctions and bids at a price lower than its valuation, makes it likely to contribute to an increase in the overall welfare by ``stealing'' auctions that will otherwise go to bidders with low valuations. This also has a positive effect on the welfare of the sellers, who get slightly better prices for their items than they would in the absence of probabilistic bidders. Still, it is true that the above results are not fully conclusive, since they are dependent on the way the market is constructed. Testing the approach in other kinds of simulated (and real) markets would be an interesting continuation to the experimental work reported here. In particular, further tests need to be conducted to determine to what extent the increase of the welfare is due to the probabilistic nature of the approach, and to what extent it is due to its systematic nature (i.e., the fact that probabilistic bidders bid in many auctions instead of just one).

Anthony et al. [1] explore an approach to design agents for bidding in English, Dutch, and Vickrey auctions. Bidding agents base their decisions upon 4 parameters: (i) the user's deadline, (ii) the number of auctions, (iii) the user's desire to bargain, and (iv) the user's desperateness for obtaining the item. For each parameter, the authors present a bidding tactic: a formula which determines how much to bid as a function of the parameter's value. A strategy is obtained by combining these 4 tactics based on a set of relative weights provided by the user. Instead of considering maximal bidding plans as in our approach, the agents in [1] locally decide where to bid next. Thus, an agent may behave desperately even if the user expressed a preference for a gradual behaviour. Indeed, if the agent places a bid in an auction whose end time is far, and if this bid is rejected at the last moment, the agent may be forced to place desperate bids to meet the user's deadline. Meanwhile, bidding in a series of auctions with earlier end times, before bidding in the auction with a later one, would allow the agent to increase its desperateness gradually. Another advantage of our approach over that of [1], is that the user can specify the desired probability of winning (eagerness), whereas in [1], the user has to tune the values and weights of the ``desperateness'' and the ``desire to bargain'', in order to express his/her eagerness. Finally, our approach takes into account partial substitutes, whereas [1] does not.

Byde [3] describes a dynamic programming approach to design algorithms for agents that participate in multiple English auctions. This approach can be instantiated to capture both greedy and optimal strategies (in terms of expected returns). Unfortunately, the algorithm implementing the optimal strategy is computationally intractable, making it inapplicable to sets of relevant auctions with more than a dozen elements. In addition, the proposed strategies are not applicable to English auctions with fixed deadlines. The auctions considered in [3] are round-based: the quote is raised at each round by the auctioneer, and the bidders indicate synchronously whether they stay in the auction or not. This type of English auction is considered in Bansal & Garg [2], where it is proven that a simple truth-telling strategy leads to Nash equilibrium.

Garcia et al [8] consider the issue of designing strategies based on fuzzy heuristics for agents bidding in series of Dutch auctions occurring in strict sequence (no simultaneity). In addition to the fact that [8] deals with Duth auctions whereas our approach deals with English, FPSB and Vickrey auctions, our proposal differs from that of [8] in that it considers overlapping auctions with potentially partial substitutes.

The first Trading Agent Competition (TAC) [9] involved agents competing to buy goods in an online marketplace. The scenario of the competition involved a set of simultaneously terminating auctions for hotel rooms, in which the agents bid to obtain rooms that they had to package with flight and entertainment tickets in such a way as to maximise a set of utility functions. This scenario differs from ours, in that the auctions all terminate simultaneously, whereas our approach handles auctions which possibly overlap, but do not necessarily terminate at the same time. In addition, our approach is applicable to different auction protocols, whereas in the TAC, all the auctions for hotel rooms were of the same type (English auctions without proxy bidding). Finally, in our approach we do not deal with packaging items into bundles, whereas in the TAC this was a central issue.

The present paper improves and extends [6], where we proposed to combine a probabilistic model with a planning algorithm to address the issue of bidding in multiple auctions. However, in [6] the algorithm BestPlan is not optimised, the case of partial substitutes is not considered, and no experimental results are reported.

In the proposed approach, an agent bids the same amount in every auction in which it participates, unless a plan revision occurs during the course of the execution phase. An alternative approach worth investigating is to allow the agent to bid a different price in each auction, even when no plan revision is required. For example, the agent could start bidding a low price and gradually increase the price as the user's deadline approaches. In this way, the agent can potentially obtain the item for an unusually low price. However, this makes the decision problem of the planning phase considerably more complex. Indeed, the algorithm would then need to consider entire sets of possible bidding prices, instead of considering a single bidding price.

As a future work, we plan to extend the proposed approach to cater for users wishing to obtain several units of an item (instead of one unit) in a set of multi-unit auctions (instead of single-unit). The challenge is to take into account the variability of offer and demand in such environments.

Algorithm 1 BestPlan'

InputnumAuctions: integer /* (positive) number of auctions */

Local variables

current: integer /* between 1 and numAuctions + 1 */

latest: integer /* between 0 and numAuctions - 1 */

best, i : integer /* between 0 and numAuctions */

path : list of integers

Pred: array [1 .. numAuctions] of integer

/* Pred(i) = best predecessor of auction */

Prob: array [0 .. numAuctions] of float

/* Prob(i) = Probability of losing when taking the best

path leading to i */

Output

- a list of integers between 1 and numAuctions /* the best

plan */

- a float /* probability of winning one auction */

Procedure

1. current := 1; /* current auction */

2. latest := 0; /* latest auction compatible with current auction

*/

3. best := 0; /* auction compatible with current one having the

lowest value for Prob */

4. Prob(best) := 1.0;

5. repeat

6. Prob(current) := (1 - Pi(r)) * Prob(best);

7. Pred(current) := best;

8. current++;

9. while end(current) - end(latest + 1) > D

10. do latest++;

11. if Prob(latest) <= Prob(best)

then best := latest fi

12. od

13. until current > numAuctions;

/* Since the auctions between latest+1 and numAuctions

have no successors, the best

path ends with an auction within the range [latest + 1, numAuctions];

the best auction within this range is computed as follows: */

14. best := latest + 1;

15. for i := latest + 2 to numAuctions

16. do if Prob(i) <= Prob(best) then best

:= i fi

17. od;

/* construction of the best path */

18. path := [];

19. i := best;

20. while i > 0

21. do path := path + [i];

22. i := Pred(i)

23. od;

24. output(path, 1 - Prob(best))

The complexity of algorithm

BestPlan' is linear in terms of the

number of auctions. The repeat-until loop is performed as many times as

there are auctions (numAuctions). The while-loop inside the repeat-until

will not have more than numAuctions - 1 iterations overall: it typically

performs zero or one iteration for each iteration of the repeat-until.

It should be noted though, that the algorithm assumes the list of auctions

to be sorted on their end times. Also, this analysis does not take into

account the complexity of the invocations to the probability functions

Pi(r) (line 6 of the algorithm).